Own Direct Working Interests in U.S. Oil and Gas Production

Join top-tier operators in a high-yield oil and gas strategy designed to deliver

early capital return, consistent income, and meaningful tax advantages.

$10M

Fund | $50K Minimum

2.2–3.5x

Target Return (inclusive of tax benefits)

80–90%

Year-One Tax Deductions (IDC + TDC)

5–7 Year

Hold | Monthly Distributions

$100M

Fund | $50K Minimum

2.2–3.5x

Target Return (inclusive of tax benefits)

80–90%

Year-One Tax Deductions

(IDC + TDC)

5–7 Year

Hold | Monthly Distributions

WATCH THE REPLAY

Exclusive Investor Webinar

Join our fund manager for an in-depth presentation on Iron Horse Energy Fund I, including live Q&A and exclusive insights into our investment strategy.

Webinar September 30th, 2025

Webinar November 10th, 2025

Why Investors Are Committing to Iron Horse Energy Fund I

Conservative 1-Year Return

Targeting up to 50% of invested capital returned within the first year.

Monthly Passive Income

Reliable cash flow through consistent monthly distributions.

Tax-Advantaged Play

80–90% year-one write-offs that can

offset active income (W2 and 1099).

Exclusive Access

Opportunities with top operators rarely

open to individual investors.

Inflation Hedge

Ownership in real assets with long-term commodity value.

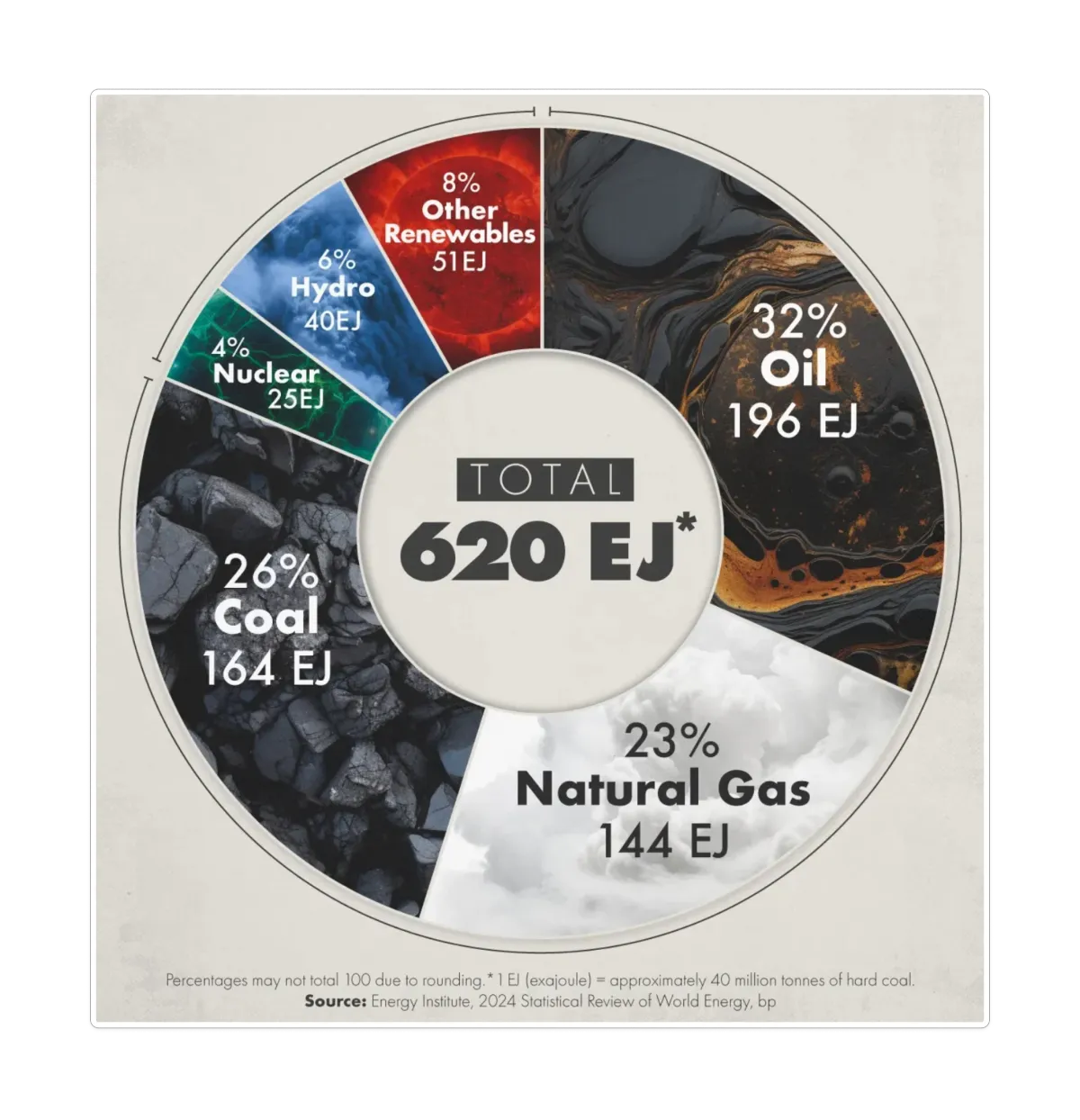

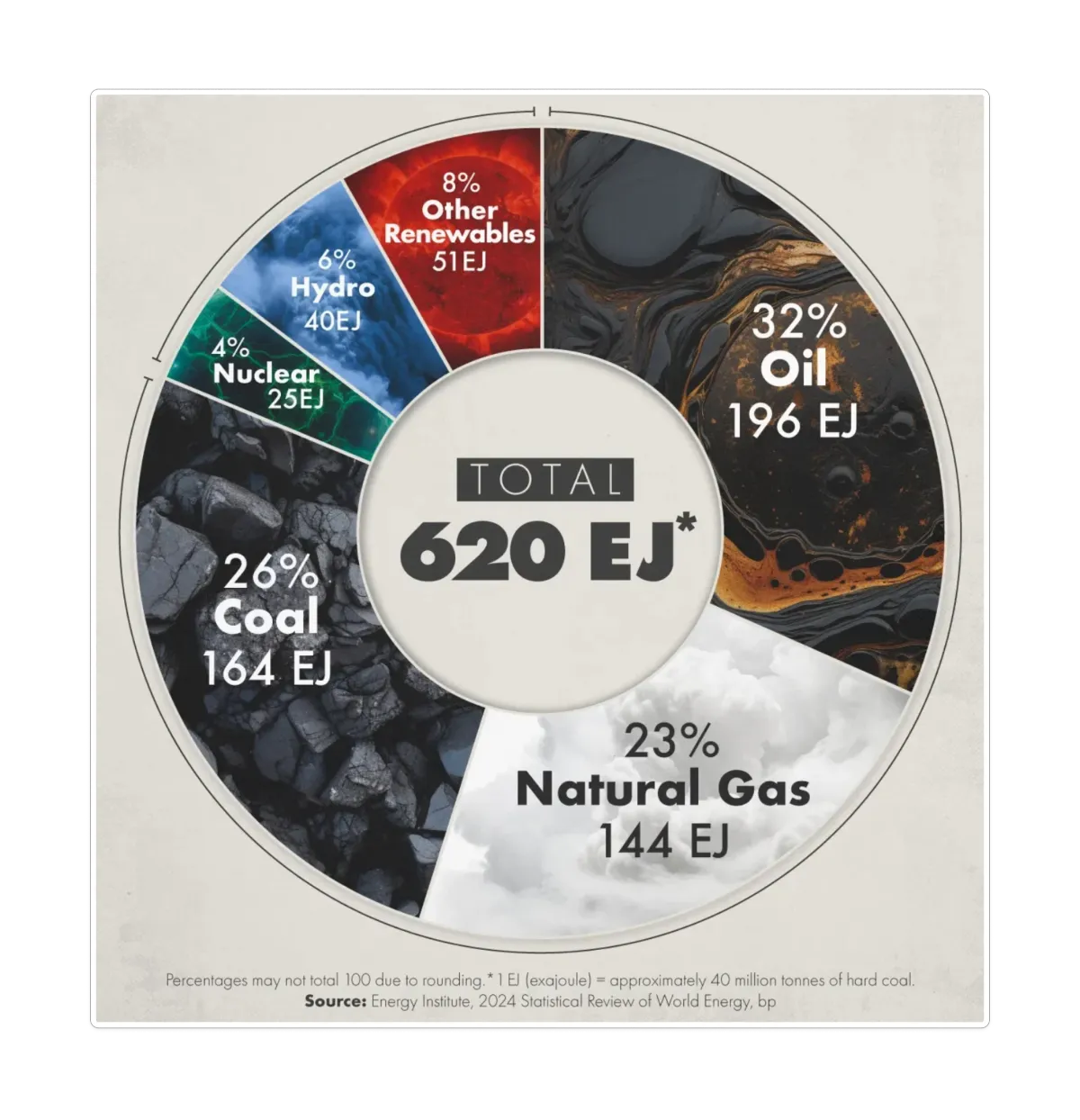

Energy Demand Is Rising.

Supply Is Constrained.

The world still runs on carbon-based energy. In 2023, 82% of global power came from oil, coal, and natural gas, and U.S. demand continues to outpace domestic production by five million barrels per day. Meanwhile, institutional capital is quietly flowing back into oil and gas—Blackstone, KKR, Warburg Pincus, and even Warren Buffett's Berkshire Hathaway have committed billions into U.S. energy since 2022.

$4T+

annual revenue

$3B/day

industry profit

28%

ownership in Occidental Petroleum (Berkshire Hathaway)

$7B+

raised by Blackstone Energy Partners

Institutional-Quality Access to an Exclusive Asset Class

Iron Horse Energy Fund I provides direct non-operated working interests (NOWI) in producing oil and gas wells. The fund's scale creates diversification across 50–100+ wells from multiple top operators, spreading risk across basins while concentrating on proven formations with low breakeven costs.

Target acquisitions must meet strict underwriting criteria:

Top operators with 1,000+ well experience

Proven basins: Permian, Niobrara, Eagle Ford, Anadarko, Bakken

≤$40 breakeven oil price

80–90% Year-One K-1 loss

500–800K estimated oil EUR per well

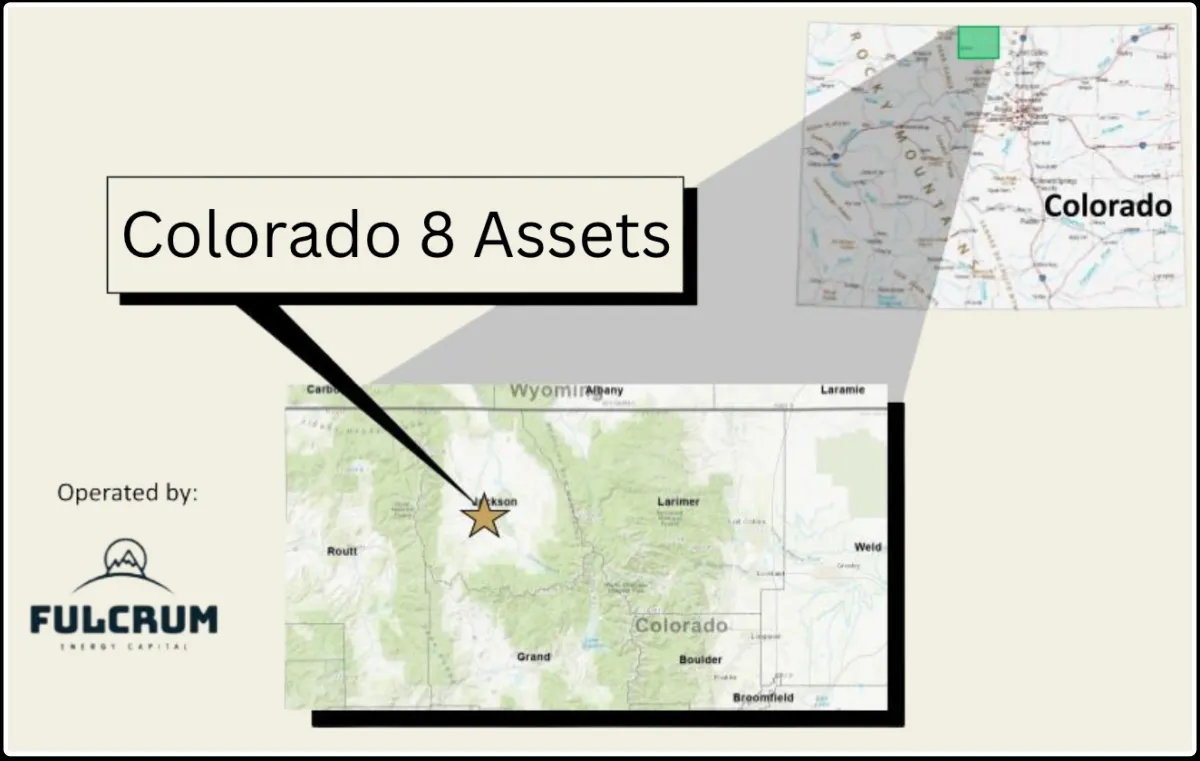

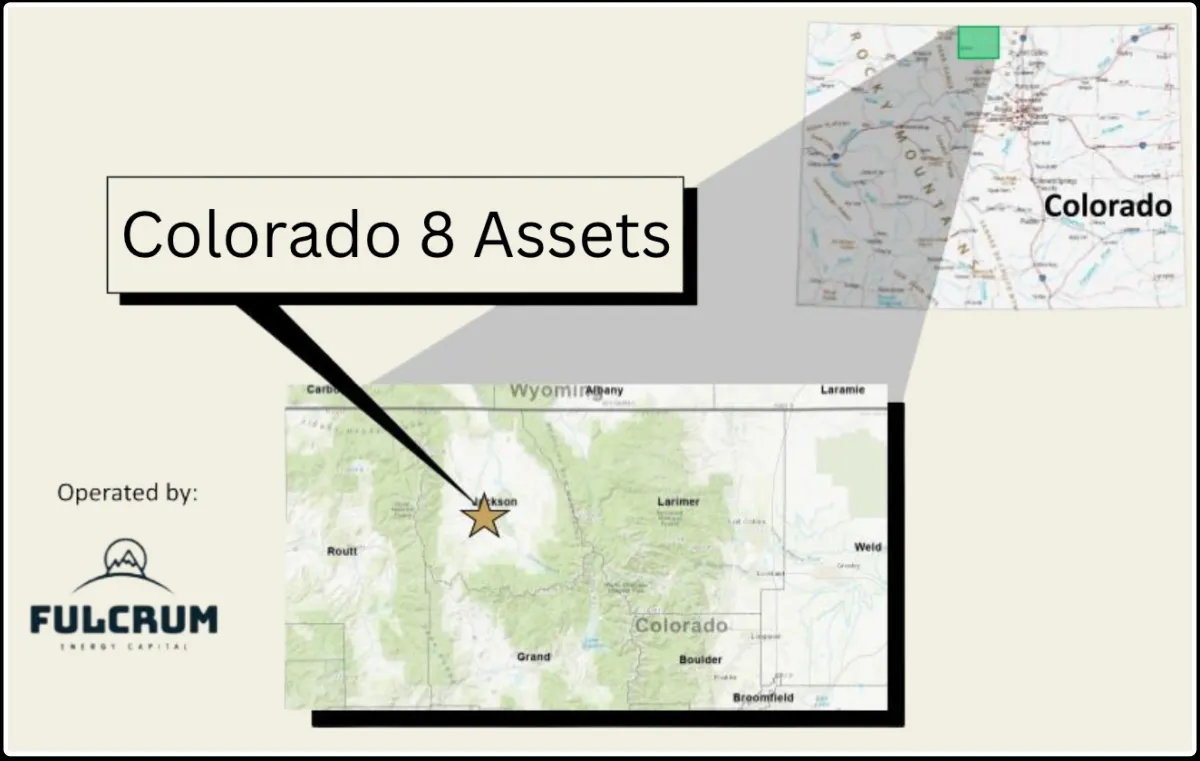

8 Wells in a Prime Niobrara Location

The Colorado 8 Asset anchors the initial portfolio, with eight wells offsetting some of the most prolific producers in Jackson County, Colorado. These wells are operated by Fulcrum Energy's award-winning Niobrara team, known for exceptional execution and technical depth.

8 wells

spud and drilling now

8.5% / 6.75%

working interest / net revenue interest per well

$11M

allocation

Nov 2025

production expected to begin

600K-1.2M

barrels offset wells show EURs

Powerful Tax Benefits Unique to Energy

Investors receive substantial first-year deductions through Intangible Drilling Costs (IDCs) and Tangible Drilling Costs (TDCs), plus a 15% annual depletion allowance against production income.

80–90%

first-year deduction

Can offset

W2, 1099, active, or passive income

Depreciation

on tangible assets over 7 years

Ongoing

depletion deductions from production revenue

Experienced Team.

Disciplined Risk Management.

Our proven track record speaks to decades of disciplined execution and risk management in

the energy sector.

175+

deals

100+

wells

150M+

barrels of oil

750+

BCF of gas

1,100+

investors

99.5%

success rate

Risk Mitigation Strategies

Diversified wells, basins, and operators

Focus on $35–$40 breakeven wells

Contingency fund for price dips

Advisory board oversight on every acquisition

Only 6 Non-Producing Wells

Out of 100+ wells drilled, our exceptional 99.5% success rate

demonstrates our rigorous due diligence and operator selection process.

Proven Basin Focus

We concentrate on established formations with predictable geology and proven production profiles, minimizing exploration risk.

Fund Terms

Transparent terms designed to align investor and fund interests while maximizing tax advantages.

Institutional-grade structure

Quarterly reporting

Professional fund administration

Raise Amount

$10 Million

Minimum Investment

$50,000

Target Return

2.2–3.5x including tax benefits

Hold Period

Estimated 7 years

Year-One Tax Loss

80–90% via IDC/TDC

Distribution Frequency

Monthly (declining as production tails)

Waterfall

90/10 to 0.8x → 70/30 to 1.5x → 50/50 thereafter

Meet the Team

Decades of combined experience in energy investments, operations, and capital markets.

Elaio Energy Leadership

Courtney Moeller

Founder & Managing Partner

U.S. Navy veteran, second-generation oil and gas entrepreneur, $40M+ AUM, 100+ wells drilled across Permian, Bakken, DJ, Powder River

Rick Boneau

Senior Landman

Veteran landman with 15+ years sourcing deals across top basins

Alexis Hildebrand

Operations Director

Fund operations and investor onboarding

Rick Weintraub

Legal Counsel

AV-rated attorney, 500+ public/private offerings, 200+ M&A transactions

Bradley Rausch

Marketing

Marketing leader building systems that attract accredited investors and drive capital raising

Vector Capital Advisory Board

Physicians, engineers, and accredited professionals contributing oversight, capital, and strategic guidance to ensure institutional-quality governance and decision-making.

The Syndication Doctor

Chirag Chaudhari

About the Fund Manager

Medicine rewards dedication but demands sacrifice. Long hours, high stress, and financial uncertainty make traditional investment routes feel unreliable.

As an Emergency Medicine Physician and Real Estate Coach, Chirag Chaudhari, MD founded The Syndication Doctor to provide physicians with a structured path to wealth accumulation—without active management or stock market volatility.

Ready to Learn More?

Personalized Investment Strategy

Tailored discussion of how this opportunity aligns with your goals

Detailed Fund Analysis

In-depth review of projections, risks, and tax implications

Direct Access to Leadership

Speak directly with the fund management team

Reserve Your Allocation

Commitments are accepted on a first-come basis until the fund reaches $10M or by November 15, 2025.

1. Submit Soft Commitment

2. Receive legal packet and accredited investor verification

3. Fund investment (wire/ACH)

IMPORTANT DISCLOSURE: This offering is made available to accredited investors only under Rule 506(c) of Regulation D. All investments involve risk and may result in partial or total loss of capital. Past performance does not guarantee future results.

Securities offered through Vector Capital, LLC. This material is for informational purposes only and does not constitute an offer to sell or solicitation of an offer to buy securities. Please read the Private Placement Memorandum carefully before investing.

© 2025 Iron Horse Energy Fund I. All rights reserved. |For accredited investors only

IMPORTANT DISCLOSURE: This offering is made available to accredited investors only under Rule 506(c) of Regulation D. All investments involve risk and may result in partial or total loss of capital. Past performance does not guarantee future results.

Securities offered through Vector Capital, LLC. This material is for informational purposes only and does not constitute an offer to sell or solicitation of an offer to buy securities. Please read the Private Placement Memorandum carefully before investing.

© 2025 Iron Horse Energy Fund I. All rights reserved. For accredited investors only